Compounded annuity formula

We also provide a Mode calculator with a downloadable excel template. Next determine the loan tenure in terms of no.

Annuity Formula What Is Annuity Formula Examples

Examples of Percentage Decrease Formula.

. Cost of Capital formula also helps to calculate the cost of the project. For example the annuity formula is the sum of a series of present value calculations. You can easily calculate the Capacity Utilization Rate using Formula in the template provided.

Cost of capital formula used for financial management of a company. The formula for Future Value of an Annuity formula can be calculated by using the following steps. When the price of an asset is considered as a function of yield duration also measures the price sensitivity to yield the rate of change of price with respect to yield or the percentage change in price for a parallel.

Relevance and Use of Growth Rate Formula. Stands for the number of periods in which payments are made The above formula pertains to the formula for ordinary annuity where the payments are due and made at the end of each month or at the end of each period. The last difference is on future value.

Here we have discussed how to calculate Mode Formula along with practical examples. It is used by an investor to choose the best investment option. Compounded Amount 5000 1 51 51.

For this example the original balance which can also be referred to as initial cash flow or present value would be 1000 r would be 0055 and n would. Typically the annual yield of government bonds or treasury bills are considered to be risk-free and as such is used as the risk-free rate of return. Typically direct labor cost direct labor hours machine hours or prime cost is used as the allocation base while the period usually selected is one year.

Luxurious Company reported the cost of. A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments. Growth Rate Final Value Initial Value Initial Value.

Next calculate the effective rate of interest which is basically the expected market interest rate divided by the number of payments to be done during the year. Finally the ordinary annuity formula can be expressed on the basis of the annuity payment step 1 no. The present value PV formula has four variables each of which can be solved for by numerical methods.

Operating Income Formula Table of Contents Operating Income Formula. WACC is used to find DCF valuation of the company. You may also look at the following articles to learn more Examples of the Gordon Growth Model Formula.

You need to provide the two inputs actual output and Maximum possible output. For a one-year period following formula can be used. We also provide a Volatility Calculator with a downloadable excel template.

Explanation of Alpha Formula. Compound interest is the product of the initial principal amount by one plus the annual interest rate raised to the number of compounded periods minus one. Examples of Absorption Costing Formula With Excel Template Absorption Costing Formula.

Now he has recently learned about the effect of compounding on the final amount at the time of maturity and seeks to calculate. Let us take the example of David who has decided to deposit a lump sum amount of 1000 in the bank for 5 years. Stands for the Interest Rate n.

Of periodic payments step 2 a period of delay step 3 and rate of interest step 4 as shown below. This is a guide to Mode Formula. The present value is given in actuarial notation by.

It is very easy and simple. This is a guide to Volatility Formula. A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan.

Here we discuss How to Calculate Volatility along with practical examples. Finally the growth rate formula can be obtained by dividing the change in value step 3 by the initial value step 1 of the metric and then express the result in terms of percentage by multiplying by 100 as shown below. For example suppose you invested 10000 in stocks in 2012 and the value grew to 14000 in 2013 to 15000 in 2014 and to 19500 in 2015.

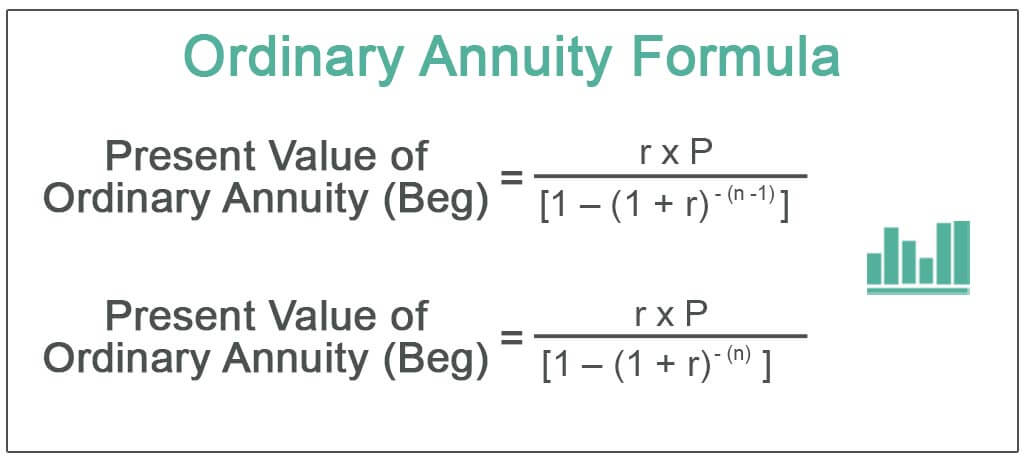

Where is the number of terms and is the per period interest rate. Ordinary Annuity P 1 1 r-n 1 r t r The annuity due formula can be explained as follows. The original balance on the account is 1000.

Cost of Capital Formula Calculator. Get 247 customer support help when you place a homework help service order with us. The formula for the predetermined overhead rate can be derived by dividing the estimated manufacturing overhead cost by the estimated number of units of the allocation base for the period.

An annuity dues future value is also higher than that of an ordinary annuity by a factor of one plus the periodic interest rate. Present value is linear in the amount of payments therefore the present. The formula for the CAGR would calculate the average amount by which the stocks value grew each year.

Firstly determine the current outstanding amount of the loan which is denoted by P. Operating income is sales revenue minus operational direct and indirect cost. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

An individual would like to determine their ending balance after one year on an account that earns 5 per month and is compounded monthly. FV of an Annuity Due FV of Ordinary Annuity. Firstly calculate the value of the future series of equal payments which is denoted by P.

You may also look at the following articles to learn more Calculator For Portfolio Return Formula. Next figure out the rate of interest to be paid on the loan and it is denoted by r. Examples of Inventory Turnover Ratio Formula Luxurious Company sells industrial furniture for the office buildings Infrastructure During the current year.

Compounded Amount Compounding Formula Example 2. The formula can be expressed as follows. The formula for CAGR calculates the average annual growth of an investment.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Capacity Utilization Rate Formula in Excel With Excel Template Here we will do the same example of the Capacity Utilization Rate formula in Excel. You can use the following Cost of Capital Calculator.

Stands for the amount of each annuity payment r. Examples of Operating Income Formula With Excel Template Operating Income Formula Calculator. Each cash flow is compounded for one additional period compared to an ordinary annuity.

Absorption Costing Formula Table of Contents Absorption Costing Formula. 10481 1 r. It is also known as operating profit or earnings before interest and taxes.

The formula for Amortized Loan can be calculated by using the following steps. Formula to Calculate Capital Asset Pricing Model. Of years which is denoted by t.

Jefferson earned the annual interest rate of 481 which is not a bad rate of return. In finance the duration of a financial asset that consists of fixed cash flows such as a bond is the weighted average of the times until those fixed cash flows are received. Where e is the base of the natural logarithm and r is the continuously compounded rate.

The formula for alpha can be derived by using the following steps. Firstly determine the risk-free rate of return for the case. Stands for Present Value of Annuity PMT.

In economics and finance present value PV also known as present discounted value is the value of an expected income stream determined as of the date of valuationThe present value is usually less than the future value because money has interest-earning potential a characteristic referred to as the time value of money except during times of zero- or negative interest rates. In management accounting absorption costing is a tool which is used to expense all costs which are linked with the manufacturing of any product.

Present Value Of An Annuity How To Calculate Examples

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Future Value Of An Annuity Annuity Teaching Mathematics

Pv Of Annuity W Continuous Compounding Formula With Calculator

Future Value Of Annuity Formula With Calculator

Annuity Due Formula Example With Excel Template

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

Future Value Of An Annuity Formula Example And Excel Template

Future Value Of An Annuity Double Entry Bookkeeping

How To Calculate The Present Value Of An Annuity Youtube

Annuity Present Value Pv Formula And Excel Calculator

Ordinary Annuity Formula Step By Step Calculation

Fv Of Annuity With Continuous Compounding Formula With Calculator

Derive The Value Of An Annuity Formula Compounded Interest Youtube

Annuity Formula Annuity Formula Annuity Economics Lessons

Present Value Of Annuity Formula With Calculator

How To Calculate The Future Value Of An Ordinary Annuity Youtube